The CPSC recently posted guidance on its website for consumer products related to COVID-19, including personal protective equipment. The guidance covers four categories of products: (a) face coverings, (b) gowns, (c) gloves, and (d) disinfectant and cleaning products. The guidance emphasizes that personal protective equipment sold to consumers must comply with all CPSC regulations, which include testing, certification, labeling, and recordkeeping requirements. The guidance drew sharp criticism from CPSC Commissioner Dana Baiocco in a statement:

This is NOT an official CPSC policy position. An official CPSC policy position requires a majority vote of the Commission. No vote was taken on the information presented on the website and certainly no vote was taken on whether a “mask” crafted during the pandemic should be regulated as “apparel” or “textiles.” In fact, no briefing, legal opinion, or analysis of the recent OMB direction was provided to this Commissioner regarding any of the opinions or “guidance” contained in the communication. Furthermore, there was no public comment or notice solicited on the matter . . . . [T]his unilateral publication suggests the potential for general legal liability and/or CPSC enforcement action—retroactively—without perspective, notice, or any deliberative process. Enough with the unilateral communications and publications. They are not approved policy. They serve only to create unnecessary public tension, confusion, and damage to the Agency’s credibility.

In a rare move, the CPSC voted recently to refer a case to the U.S. Department of Justice asking it to pursue and litigate a civil penalty for violations of the Consumer Product Safety Act. Usually, the CPSC does not disclose such referrals to the public. Yet CPSC Acting Chairman Robert Adler issued a statement about this referral. Although the referral’s details remain confidential, Adler took “the unusual step of announcing this action to assure the American public that the enforcement process at CPSC—thought by some to be dormant—is continuing.” Adler’s statement refers to the decline in civil penalties obtained by the CPSC in recent years when compared to the millions in civil penalties imposed annually on manufacturers, distributors, retailers, and importers between 2007 to 2017.

Lawyers from Hunton Andrews Kurth LLP’s insurance coverage practice provide an update on two recent food contamination-related insurance disputes:

Court Rejects Insurer’s Late-Notice Defense, Allowing Meat and Poultry Producer Recall Claim to Proceed

Recall insurance—like other policies—often involves potential issues related to notice requirements. A threshold question in those disputes is what facts or circumstances trigger the obligation to provide notice in the first place. A recent court ruling clarifies the significance of the notice-trigger under a product contamination insurance policy.

The case was filed by George’s Inc. and affiliated companies that were all involved in producing ready-to-eat (RTE) meat and poultry products and had incurred more than $3 million in losses. To protect against risks related to salmonella contamination and product recalls, George’s purchased insurance. The policy required notice within 30 days upon “first discovery of [an] incident that may be covered under the terms of this Policy.” The insurers argued that the 30-day deadline should have started when the United States Department of Agriculture (USDA) notified George’s of a single positive salmonella test resulting from the government’s routine product testing. George’s argued that the USDA notice was insufficient to start the clock because it had to evaluate if the various requirements for coverage were, in fact, satisfied. That process took some time, George’s contended, and so the 30-day window did not start upon receiving the USDA notice.

The court agreed with George’s. Applying governing Arkansas law, the court recognized that “an insured must strictly comply with an insurance policy notice provision” and that insurers were not required to show any prejudice because the notice provision was a condition precedent under the policy. However, the court rejected the insurers’ argument that George’s failed to state a claim due to late notice. The court noted that, after the initial positive test, George’s “still needed to investigate further to determine whether an Insured Event had occurred” and had to evaluate the quantity of the product that was potentially impacted. As a result, the court found that George’s had “plausibly alleged that [it] did not ‘discover an Insured Event” until six weeks after the initial test results and allowed the case to proceed.

Georgia Court Denies Insurer’s Early Motion to Escape Contribution Claim Arising from $51 Million Product Recall Coverage Dispute

As previously reported on the Hunton Insurance Recovery Blog, a federal judge recently denied an insurance company’s motion to dismiss the claims of another insurer seeking reimbursement and contribution for the $15 million it paid to settle underlying claims arising from a product recall.

In May 2016, Grain Craft, an independent flour miller, voluntarily recalled certain flour orders that were contaminated by trace amounts of peanut protein. Grain Craft’s customers asserted claims against the company and its insurers, seeking compensation for “property damage” incurred from incorporating the contaminated flour into their products. The insurers covered the customers’ claims under two separate towers of insurance including several general liability, umbrella, and excess policies. One excess insurer, Travelers, paid $15 million to resolve various recall-related claims. Travelers then filed a complaint against the other insurers to recoup its $15 million payout, alleging that the other insurers did not properly exhaust their policy limits and were unjustly enriched by Travelers’ payment.

North River, the excess insurer directly above Travelers in the two insurance towers, moved to dismiss Travelers’ complaint for failure to state a claim. North River characterized Travelers’ allegations that North River was “unjustly enriched” and that Travelers was entitled to recover its payment as “conclusory statements devoid of factual enhancement” that are “not entitled to the assumption of truth.” Specifically, North River argued that Travelers’ bare allegations were because North River cannot be liable for equitable contribution because it “sits atop Travelers” and, therefore, had no obligation to pay the recall claims unless and until Travelers had first exhausted its limits.

Following virtual oral argument, the judge denied North River’s motion to dismiss, finding that there could be a legal basis for the claim of recovery. The judge ordered the parties to attend mediation within the next 60 days and to proceed with discovery. The judge reportedly expressed skepticism about the viability of Travelers’ unjust enrichment claim but concluded that discovery would reveal each insurer’s responsibility for allocating the settlement payments at issue.

Insurance coverage for product recall-related claims can come in various sources. Companies can purchase standalone recall policies, which typically cover the costs of shipping, storing, and disposing of the recalled products, the cost of damage products caused by contamination, loss of profits resulting from the call, and other kinds of rehabilitation and crisis-related expenses. Recall coverage, however, can also come from “traditional” policies, like commercial general liability and umbrella policies, which can be triggered because of the allegations of “bodily injury” or “property damage.” For example, Grain Craft’s customers triggered coverage under the company’s liability policies by alleging property damage when the customers incorporated contaminated flour into their products.

In the Grain Craft dispute, the insurers took appropriate steps by first protecting the policyholder in resolving the underlying claims and then pursuing various legal and equitable claims amongst themselves to attempt to allocate loss. North River’s position that generic allegations of unjust enrichment and entitlement to recoupment of insurance payments were insufficient to state a claim was noteworthy, as many times it is the policyholder making those arguments in disputing recoupment claims by insurance companies. The excess insurer in this case was unsuccessful, at least until discovery concludes. We will continue to monitor this interesting recall dispute for further developments.

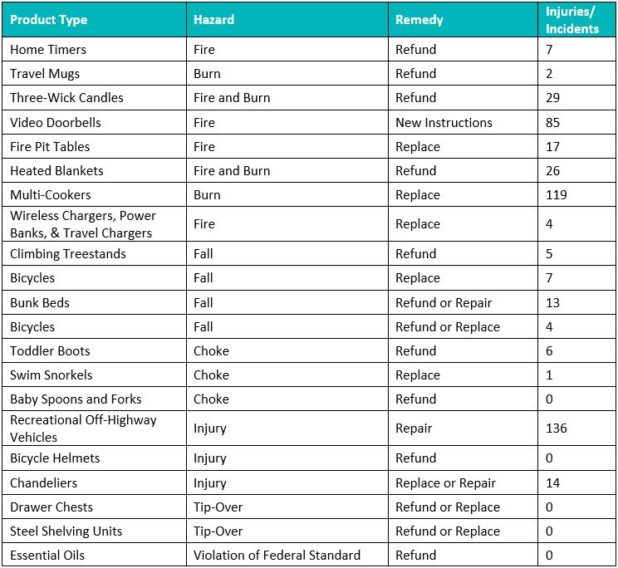

Total Recalls: 21

Hazards: Fire/Burn/Shock (8); Fall (4); Choke (3); Injury (3); Tip-Over (2); Violation of Federal Standard (1)

- Partner

Syed represents clients in connection with insurance coverage, reinsurance matters and other business litigation. Syed serves as the head of the firm’s insurance coverage practice. He has been admitted to the US Court of Appeals ...

- Partner

Kelly practices as a commercial and regulatory litigator on products liability and post M&A disputes and issues and serves as one of the firm’s Deputy General Counsel focusing on law firm ethics, conflicts, and risk management ...

- Partner

Geoff works closely with corporate policyholders and their directors and officers to resolve high-stakes insurance disputes. He leads the Firm’s D&O insurance and executive protection practice.

As a partner in Hunton’s ...

Search

Recent Posts

Categories

- Advertising & Marketing

- Bankruptcy

- Class Action

- Competition/Antitrust

- Consumer Protection

- Corporate Governance

- Environmental

- General

- Health Care

- Insurance

- IP

- Labor and Employment

- Mergers & Acquisitions

- Patent Infringement

- Patents

- Privacy & Cybersecurity

- Product Liability

- Real Estate

- Regulatory

- Regulatory

- Technology & E-Commerce

Tags

- 29 C.F.R. § 785.48

- 396-r

- 3D Printer

- 3D Printing

- A. Todd Brown

- A.S. Research (ASR)

- Aaron P. Simpson

- Advertisers

- Advertising

- Advertising Claims

- Advertising Idea

- Agency Guidance

- AI

- AI Interviewing Platforms

- Algorithmic Accountability Act

- Align

- Americans with Disabilities Act

- Americans with Disabilities Act (ADA)

- Andrea DeField

- Ann Marie Buerkle

- Annual Reports

- anti-aging

- Anti-Discrimination

- APEX Agreement

- Arbitration

- Arbitration Agreements

- Arizona

- Arkansas

- Arthritis

- Artificial Intelligence

- Artificial Intelligence (AI)

- Asbestos

- Assembly Bill 51 (AB 51)

- ATDS

- Australia

- Auto-renewals

- automatic telephone dialing system (ATDS)

- Automobile

- Automotive Body Parts Association (ABPA)

- Back to Work Emergency Ordinance

- biased endorsements

- Biden Administration

- Biometric Data

- Biometric Information

- Biometric Information Privacy Act (BIPA)

- BIPA

- Bitcoin

- Blockchain

- Board Diversity Disclosure

- Boards of Directors

- Bonuses

- Braille

- Branding

- Breach

- Breach of Contract

- Business Interruption Loss

- Businessowner’s Insurance

- California

- California Assembly Bill 2011

- California Employment Laws

- California Fair Employment and Housing Act

- California False Claims Act

- California Labor Code

- California Senate Bill 6

- California’s Unfair Competition Law

- CAMS

- Canada

- Cannabis

- CBD

- CBP

- CCPA

- Celebrity Endorsers

- Center for Disease Control (CDC)

- CFIUS

- CGL

- Chatbot

- Children’s Advertising

- Children’s Advertising Review Unit

- Children’s Online Privacy Protection Act (COPPA)

- China

- Christopher J. Dufek

- Christopher W. Hasbrouck

- Christy Kiely

- Class Action

- Class Actions

- Clawback

- Click-to-Cancel

- Climate Change

- clinical trials

- Collective Action

- Colorado

- Commercial General Liability

- Commercial Leasing

- Commodity Futures Trading Commission

- Compliance

- Congress

- Connecticut

- Consent

- Consent Order

- Consumer Data

- Consumer Financial Protection Bureau

- Consumer Fraud

- consumer loyalty program

- Consumer Product Safety Act

- Consumer Products

- Consumer Products Safety Commission (CPSC)

- Consumer Protection

- Consumer Review Fairness Act of 2016 (CRFA)

- Consumer Reviews

- Contamination

- Contract Law

- Controlled Substance Act

- Cookware

- COPPA

- Copyright

- Coronavirus/COVID-19

- Corp Fin

- Corporate Governance

- Corporate Reporting

- Corporate Sustainability

- Counterfeit Goods

- Counterfeit Goods Seizure Act of 2019

- CPRA

- CPSA

- CPSC

- Crack House Statute

- CRFA

- Cryptocurrency

- CSPA

- Cuba

- Currency

- Customs and Border Protection

- Cyber Coverage

- D&O

- D&O policies

- D. Andrew Quigley

- Damages

- Data Breach

- Davidson

- Deceptive Advertising

- DEI

- Delaware

- DEP

- Department of Justice

- Department of Labor

- Development Impact Fee

- Digital Assets

- digital currency

- Disclosures

- Distribution

- Division of Corporation Finance

- Dodd-Frank

- DOJ

- DOL

- Duty to Defend

- Duty to Indemnify

- e-liquid products

- Eddie Bauer

- EEOC

- Electric Vehicles

- Eleventh Circuit

- Emily Burkhardt Vicente

- Employee Rights

- Endorsement

- Endorsement Guides

- Endorsement Notice

- Endorsements

- endorser monitoring requirements

- Enforcement

- Environmental Protection Agency

- Environmental Protection Agency (EPA)

- EPA

- Epidemic

- ESG

- ESG Disclosure

- EU Regulation

- European Union

- European Unitary Patent

- EV Charging

- Exceptions

- Exclusions

- Exercise Machines

- Extended Producer Responsibility (EPR)

- FAA

- Fair Labor Standards Act

- Fair Labor Standards Act (FLSA)

- fair use

- False Advertising

- False Advertising Claims

- False Advertising Law

- False Claims Act

- Family Leave Policies

- FCC

- FCRA

- FDA

- Federal Arbitration Act (FAA)

- Federal Communications Commission

- Federal District Court

- Federal Trade Commission

- Federal Trade Commission (FTC)

- FFDCA

- FIFRA

- Fifth Circuit

- Final Rule

- Fireworks

- First Amendment

- Fixing America’s Surface Transportation (FAST) Act

- Florida

- Florida House of Representatives (HB 963) and Florida Senate (SB 1670)

- Florida Legislature

- FLSA

- FLSA/Wage & Hour

- food delivery

- Food Safety

- Form 10-K

- Formaldehyde Standards for Composite Wood Products Act of 2010

- fractional interests

- Franchise

- Frederic Chang

- Free Trials

- FTC

- FTC Act

- Gavin Newsom

- GDPR

- General Liability

- Geoffrey B. Fehling

- Georgia

- Gift Cards

- GoodRx

- Gramm-Leach-Bliley (GLB) Act

- Green

- Green Guides

- Greenhouse Gas

- Gun Safety

- Hart-Scott-Rodino

- Hart-Scott-Rodino (HSR)

- hashtag

- Hawaii

- Health Care

- Health Claims

- Hedge Fund

- HIPAA

- hoverboards

- human capital

- Human Rights

- Illinois

- Illinois Artificial Intelligence Video Interview Act (the Illinois Act)

- Illinois Biometric Information Privacy Act (BIPA)

- Indiana

- Influencer Marketing

- Infringement

- initial public offerings (IPOs)

- Injury

- Insurance

- Insurance Loss

- Insurance Provider

- Intellectual Property

- Intellectual Property Licenses in Bankruptcy Act

- Interest Rate

- International

- International Trade Commission

- International Trade Commission (ITC)

- INVISALIGN

- Iowa

- IP

- Ireland

- IT

- ITC

- iTERO

- Junk Fees

- Katherine Miller

- Kurt A. Powell

- Kurt G. Larkin

- Labeling Rules

- Labor

- Labor Code Private Attorneys General Act of 2004 (PAGA)

- Labor Organizing

- Labor Unions

- Land Use

- Landlord

- Latin America

- Lautenberg Act

- Lawsuit Reform Alliance of New York (LRANY)

- Lead

- Lease

- Legislation

- Leveraged Loans

- Liability Insurance Policy

- Liberty Insurance Corporation

- Liberty Mutual Fire Insurance Company

- LIBOR Discontinuation

- liquidity

- Litigation

- Live Chat

- Louisiana

- M&A

- Made in the USA

- Made in USA

- MagicSleeve

- Magnuson-Moss Warranty Act

- Magnuson-Moss Warranty Act (MMWA)

- Maine

- Malcolm C. Weiss

- Manufacturing

- Marketing Claims

- Maryland

- Massachusetts

- Matthew T. McLellan

- Maya M. Eckstein

- MD&A

- Medtail

- Membership cancellation

- Metaverse

- MeToo Movement

- Mexico

- Michael J. Mueller

- Michael S. Levine

- Minimum Wage

- Minnesota

- Minnesota Pollution Control Agency (MPCA)

- Misclassification

- Mislabeling

- Mission Product Holdings

- Missouri

- Mobile

- Mobile App

- Multi-Level Marketing Program (MLM)

- NAA

- NAD

- NASA

- National Advertising Division

- National Advertising Division (NAD)

- National Advertising Review Board

- National Products Inc.

- National Retail Federation

- Natural Disaster

- Nebraska

- Neil K. Gilman

- Network Outage

- Nevada

- New Jersey

- New York

- NHTSA

- NIL rights

- Ninth Circuit

- NLRA

- NLRB

- no-action request

- non-fungible token (NFT)

- North Carolina

- Obama Administration

- Occupational Safety and Health Administration (OSHA)

- Occurrence

- Office of Labor Standards Enforcement

- Ohio

- Oklahoma

- Online Cash Providers

- Online Retailer

- online reviews

- Opioids

- Oregon

- Overboarding

- Overtime

- Overtime Exemptions

- Ownership

- Packaging

- PAGA

- Pandemic

- Patent

- Patent Infringement

- Patents

- Paul T. Moura

- Pay Ratio

- pay-to-play rankings

- Penalty

- Pennsylvania

- Personal and Advertising Injury

- Personal Data

- Personal Information

- Personally Identifiable Information

- Pesticides

- PFAS

- Physical Loss or Damage

- Policy

- price gouging

- Privacy

- Privacy Guidelines

- Privacy Policy

- Privacy Protections

- Prohibition on Sale

- Property Insurance

- Property Rights

- Proposition 65

- Proxy Access

- proxy materials

- Proxy Statements

- Public Companies

- Purdue Pharma

- Randall S. Parks

- Ransomware

- real estate

- Recall

- Recalls

- Regulation

- Regulation S-K

- Restaurants

- Restrictive Covenants

- Retail

- Retail Development

- Retail Industry Leaders Association

- Retail Litigation Center

- Rounding

- Rulemaking

- Ryan A. Glasgow

- Sales Tax

- Scott H. Kimpel

- SD8 coins

- SEC

- SEC Disclosure

- Second Circuit

- Section 337

- Section 365

- Secure and Fair Enforcement Banking Act of 2019 (“SAFE Banking Act”)

- Securities

- Securities and Exchange Commission

- Securities and Exchange Commission (SEC)

- security checks

- Senate

- Senate Data Handling Report

- Sergio F. Oehninger

- Service Contract Act (SCA)

- Service Provider

- SHARE

- Shareholder

- Shareholder Proposals

- Slogan

- Smart Contracts

- Social Media

- Social Media Influencers

- Software

- South Carolina

- South Dakota

- Special purpose acquisition companies (SPACs)

- State Attorneys General

- Store Closures

- Subscription Services

- Substantiation

- Substantiation Notice

- Supplier

- Supply Chain

- Supply contracts

- Supreme Court

- Sustainability

- Syed S. Ahmad

- Synovia

- Targeted Advertising

- Tax

- TCCWNA

- TCPA

- Technology

- Telemarketing

- Telephone Consumer Protection Act

- Telephone Consumer Protection Act (TCPA)

- Tempnology LLC

- Tenant

- Tennessee

- Terms and Conditions

- Texas

- the Fair Credit Reporting Act (FCRA)

- Thomas R. Waskom

- Title VII

- tokenization

- tokens

- Toxic Chemicals

- Toxic Substances Control Act

- Toxic Substances Control Act (TSCA)

- Trade Dress

- Trademark

- Trademark Infringement

- Trademark Trial and Appeal Board (TTAB)

- TransUnion

- Travel

- Trump Administration

- TSCA

- TSCA Title VI

- U.S. Department of Justice

- U.S. Department of Labor

- U.S. Food and Drug Administration

- U.S. House of Representatives

- U.S. Patent and Trademark Office

- Umbrella Liability

- Union

- Union Organizing

- United Specialty Insurance Company

- Unmanned Aircraft

- Unruh Civil Rights Act

- UPSTO

- US Chamber of Commerce

- US Customs and Border Protection (CBP)

- US Environmental Protection Agency (EPA)

- US International Trade Commission (ITC)

- US Origin Claims

- US Patent and Trademark Office

- US Patent and Trademark Office (USPTO)

- US Supreme Court

- USDA

- USPTO

- Utah

- Varidesk

- Vermont

- Virginia

- volatile organic compound (VOC) emissions

- W. Jeffery Edwards

- Wage and Hour

- Walter J. Andrews

- Warranties

- Warranty

- Washington

- Washington DC

- Web Accessibility

- Weight Loss

- Wiretapping

- World Health Organization (WHO)

- Wyoming

- Year In Review

- Zoning Regulations

Authors

- Gary A. Abelev

- Alexander Abramenko

- Yaniel Abreu

- Syed S. Ahmad

- Nancy B. Beck, PhD, DABT

- Brandon Bell

- Fawaz A. Bham

- Michael J. “Jack” Bisceglia

- Jeremy S. Boczko

- Brian J. Bosworth

- Shannon S. Broome

- Samuel L. Brown

- Tyler P. Brown

- Melinda Brunger

- Jimmy Bui

- M. Brett Burns

- Olivia G. Bushman

- Matthew J. Calvert

- María Castellanos

- Grant H. Cokeley

- Abigail Contreras

- Alexandra B. Cunningham

- Merideth Snow Daly

- Javier De Luna

- Timothy G. Decker

- Andrea DeField

- John J. Delionado

- Stephen P. Demm

- Mayme Donohue

- Nicholas Drews

- Christopher J. Dufek

- Robert T. Dumbacher

- M. Kaylan Dunn

- Chloe Dupre

- Frederick R. Eames

- Maya M. Eckstein

- Tara L. Elgie

- Clare Ellis

- Latosha M. Ellis

- Juan C. Enjamio

- Kelly L. Faglioni

- Ozzie A. Farres

- Geoffrey B. Fehling

- Hannah Flint

- Erin F. Fonté

- Kevin E. Gaunt

- Andrew G. Geyer

- Armin Ghiam

- Neil K. Gilman

- Ryan A. Glasgow

- Tonya M. Gray

- Aidan Gross

- Elisabeth R. Gunther

- Steven M. Haas

- Kevin Hahm

- Jason W. Harbour

- Jeffrey L. Harvey

- Christopher W. Hasbrouck

- Eileen Henderson

- Gregory G. Hesse

- Kirk A. Hornbeck

- Rachel E. Hudgins

- Jamie Zysk Isani

- Nicole R. Johnson

- Roland M. Juarez

- Suzan Kern

- Jason J. Kim

- Scott H. Kimpel

- Andrew S. Koelz

- Leslie W. Kostyshak

- Perie Reiko Koyama

- Torsten M. Kracht

- Brad Kuntz

- Kurt G. Larkin

- Tyler S. Laughinghouse

- Matthew Z. Leopold

- Michael S. Levine

- Ashley Lewis

- Abigail M. Lyle

- Maeve Malik

- Phyllis H. Marcus

- Eric R. Markus

- Brandon Marvisi

- John Gary Maynard, III

- Aubrianna L. Mierow

- Gray Moeller

- Reilly C. Moore

- Michael D. Morfey

- Ann Marie Mortimer

- Michael J. Mueller

- J. Drei Munar

- Marcus E. Nelson

- Matthew Nigriny

- Justin F. Paget

- Christopher M. Pardo

- Randall S. Parks

- Katherine C. Pickens

- Gregory L. Porter

- Kurt A. Powell

- Robert T. Quackenboss

- D. Andrew Quigley

- Michael Reed

- Shawn Patrick Regan

- Jonathan D. Reichman

- Kelli Regan Rice

- Patrick L. Robson

- Amber M. Rogers

- Natalia San Juan

- Katherine P. Sandberg

- Arthur E. Schmalz

- Daniel G. Shanley

- Madison W. Sherrill

- Kevin V. Small

- J.R. Smith

- Bennett Sooy

- Daniel Stefany

- Katherine Tanzola

- Javaneh S. Tarter

- Jessica N. Vara

- Emily Burkhardt Vicente

- Mark R. Vowell

- Gregory R. Wall

- Thomas R. Waskom

- Malcolm C. Weiss

- Holly H. Williamson

- Samuel Wolff

- Steven L. Wood

- Jingyi “Alice” Yao

- Jessica G. Yeshman